Different Types of Loans

Loans are a fundamental part of our financial landscape, helping us achieve various goals, from buying a dream home to financing an education or starting a business. But with so many options available, navigating the world of loans can be overwhelming. This blog aims to simplify things by providing a comprehensive overview of different types of loans, empowering you to make informed decisions for your financial needs.

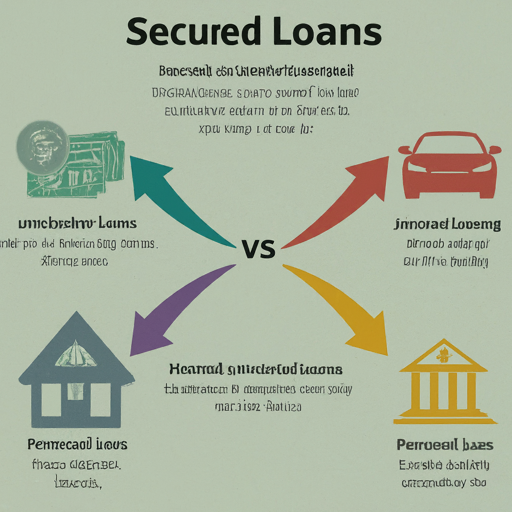

Secured vs. Unsecured Loans:

The primary distinction lies in the presence of collateral. Secured loans require you to pledge an asset, like a car or house, as security. If you fail to repay the loan, the lender can seize the collateral to recoup their losses. Secured loans often come with lower interest rates due to the reduced risk for the lender.

On the other hand, unsecured loans don’t require collateral. Instead, they are based on your creditworthiness, income, and employment history. While convenient, unsecured loans typically have higher interest rates reflecting the increased risk for the lender.

Common Loan Types:

- Home Loans:Secured loans specifically designed for financing the purchase, construction, or renovation of a property.

- Auto Loans:Secured loans used to finance the purchase of a vehicle.

- Personal Loans:Unsecured loans used for various purposes, such as debt consolidation, home improvement, or unexpected expenses.

- Student Loans:Unsecured or secured loans designed to help finance higher education.

- Business Loans: Loans tailored to meet the needs of businesses, including startups and established companies. They can be secured or unsecured, depending on the lender and your business profile

Additional Factors to Consider:

- Interest Rates:This is the cost of borrowing money, expressed as a percentage of the loan amount. It’s crucial to compare interest rates offered by different lenders before finalizing a loan.

- Loan Term:This refers to the duration within which you must repay the loan, impacting your monthly installments.

- Repayment Options:Some lenders offer flexible repayment options, such as fixed or adjustable interest rates, or the ability to make bi-weekly payments to accelerate debt repayment.

Remember

Borrowing money is a significant financial decision. Carefully evaluate your needs, compare loan options, and consult a financial advisor if needed, to ensure you choose the right loan that aligns with your financial goals and capabilities.